Home sales across the board, comparing 3Q2010 and 3Q2011, have increase, activity increased 1.7%, latest patterns offers signs of a finding a bottom to the housing bust.

Next year, the market will continue to work through the shadow inventory of foreclosures. Banks will not flood the market with foreclosures, that would further weakening the housing market, but we will continue to see a steady stream. In Texas is below 30% foreclosure and we fair better than other states in foreclosure because we did not see the appreciation in home values other states achieved in their market.

What does this mean in the Austin market? For buyers there are still deals to be found. However in the Austin market, we have 100% saturation in apartment rentals, and rents all over Austin are increasing we will see more and more qualified buyers move off the fence. Sellers are still holding tight. We are experiencing a low number of listings but ever increasing sales. The best homes that are price competitively are going fast.

Showing posts with label Housing. Show all posts

Showing posts with label Housing. Show all posts

Monday, February 27, 2012

Monday, November 21, 2011

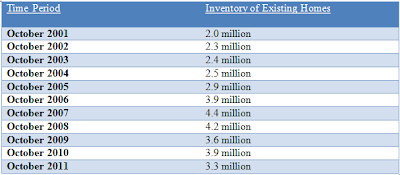

Lowest Inventory in Six Years

The total homes listed for sale continue to move downward. The latest decline in October to 3.33 million was partly seasonal, as autumn and winter months nearly always have fewer listings in comparison with spring and summer months. Still, examining listings only in the month of October (so as to get an apple-to-apple comparison), this year saw the lowest inventory since 2005.

A review of June, July, August, and September data also says the same thing: namely, 2011 had the lowest inventory count since 2005 across same-month comparisons. The market is clearly healing and the falling inventory is an early indicator as to what will happen to home prices in the future.

Despite the improving inventory trend, let’s be mindful that the current inventory conditions are still considered elevated and above normal compared to the early years of the last decade. Also the months-supply – i.e., how many months it would take to exhaust the current inventory assuming the current sales pace – stood at 8 months in October, which is still a tad above normal conditions. Ideally, the months-supply figure needs to fall to about 6 months before prices show consistent positive movement of about 3 to 5 percent annually.

Separately, the inventory of newly constructed homes (not existing home inventory) is at 40 year lows because homebuilders have just not been able to break ground and build new homes because of very difficult lending conditions in obtaining construction loans. The inventory trends for both existing and new homes should therefore provide some reassurance that home price growth (at the national level) could be just around the corner. Local markets in Bismarck, Buffalo, Pittsburgh, San Diego, and Washington, D.C., as some examples, have already shown consistent price gains.

Source - National Association of Realtors - Economic Outlook 11-12-2011

A review of June, July, August, and September data also says the same thing: namely, 2011 had the lowest inventory count since 2005 across same-month comparisons. The market is clearly healing and the falling inventory is an early indicator as to what will happen to home prices in the future.

Despite the improving inventory trend, let’s be mindful that the current inventory conditions are still considered elevated and above normal compared to the early years of the last decade. Also the months-supply – i.e., how many months it would take to exhaust the current inventory assuming the current sales pace – stood at 8 months in October, which is still a tad above normal conditions. Ideally, the months-supply figure needs to fall to about 6 months before prices show consistent positive movement of about 3 to 5 percent annually.

Separately, the inventory of newly constructed homes (not existing home inventory) is at 40 year lows because homebuilders have just not been able to break ground and build new homes because of very difficult lending conditions in obtaining construction loans. The inventory trends for both existing and new homes should therefore provide some reassurance that home price growth (at the national level) could be just around the corner. Local markets in Bismarck, Buffalo, Pittsburgh, San Diego, and Washington, D.C., as some examples, have already shown consistent price gains.

Source - National Association of Realtors - Economic Outlook 11-12-2011

Friday, May 6, 2011

Mortgage Foreclosures: Documentation Problems

Based on a report from the GAO, more regulatory action is coming. The report highlights a lack of consistency among mortgage servicing companies and how they handle their documentation in the foreclosure process. The Federal government has little statutory impact, most foreclosure laws are on a state level. To read more, click here. To search for foreclosures in your area click here.

Friday, September 17, 2010

Growing your Real Estate Practice: The Next Wave

In the coming years, it is estimated 55M “seniors” born 1925 to 1946 (G.I. Generation, Silent Generation & Boomers) will be entering the residential housing market place. When will depended on your market but it would be wise to being your preparation now.

Prepare now in order to tap into the “senior” resource by actively marketing and building referral base.

To effectively work with this demographic:

• Know the your local market

• Reach where they live, eat and meet

• Find and tap into local senior resources

• Build a senior friendly network

• Actively market to seniors moving into/out of your area.

• Learn what is important to them

Prepare now in order to tap into the “senior” resource by actively marketing and building referral base.

To effectively work with this demographic:

• Know the your local market

• Reach where they live, eat and meet

• Find and tap into local senior resources

• Build a senior friendly network

• Actively market to seniors moving into/out of your area.

• Learn what is important to them

Subscribe to:

Posts (Atom)